Recent Mergers and Acquisitions in India

- Finomenon NMIMS

- Nov 4, 2019

- 4 min read

Updated: Nov 9, 2019

Merger of Bank Of Baroda, Vijaya Bank and Dena Bank

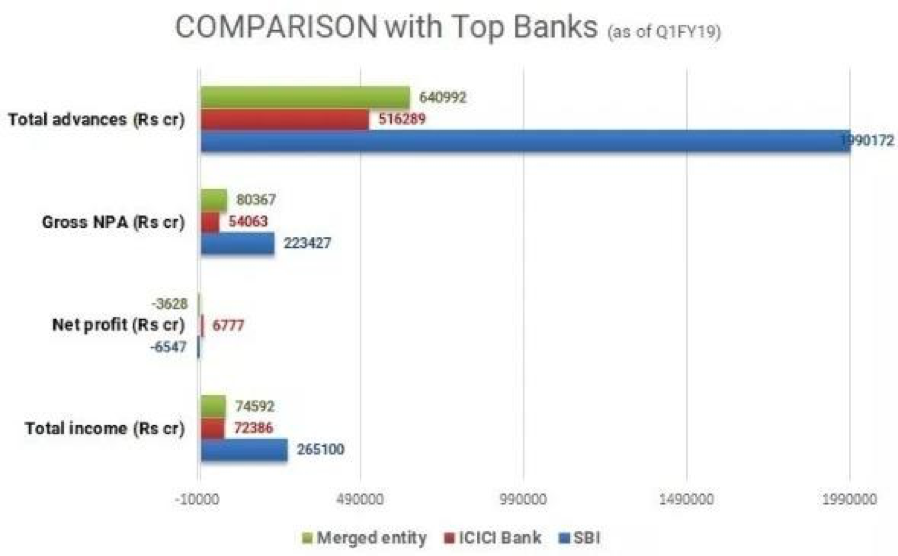

The merger came into effect from April 1, 2019 (to be completed over the span of 2 years), making Bank of Baroda the 3rd largest bank in India after SBI and HDFC bank, with a business of Rs.15 trillion. The assets of the merged entity will stand at Rs.10.44 trillion. The customers of Dena Bank and Vijaya Bank are the account holders of BOB now. The combined synergy of the banks is aimed at developing better relationships with clients by offering world class services by robust processes. The power of 3 became an organic thought for campaign with the campaign line “Ab Saath Hain Teen, Behtar Se Behtareen” which is inspired by the adage- whole is always bigger than the sum of its parts.

Such massive consolidation is also expected to reduce the lending cost, the number of NPAs and increase the merged bank's operational stability and profitability. The central government had, previously in 2017 as well, merged six banks into State Bank of India, making it the largest banking conglomerate. One of the reasons why government wanted a merger of the two banks with Bank of Baroda is that all the banks use the same software- Finacle from Infosys making the task of merging the technology platforms and back-ends easier.

After the merger, the no. of public sector banks will reduce from 21 to 19 and BOB will enjoy the increase in reach across India with 9500 branches and 13400 ATMs. The consolidated entity started the operation with a business mix of over Rs 15 lakh crore on the balance sheet, with deposits and advances of Rs 8.75 lakh crore and Rs 6.25 lakh crore, respectively.

To strengthen the balance sheet of the merged entity and meet its credit and contingency needs, the government has decided to infuse ₹5,042 crore into Bank of Baroda by way of preferential allotment of equity shares. According to the share swap ratio, the shareholders of Vijaya Bank will get 402 shares and Dena bank shareholder to receive 110 equity shares of Bank of Baroda for every 1000 shares. The government’s shareholding in the merged entity will rise from 63.7% to 65.7%.

According to a Moody’s report, the profitability of BOB might fall due to the NPAs of the other two banks. As a percentage of total assets, Dena Bank has the highest net non- performing assets at 11.04% while Vijaya Bank has 4.10% and Bank of Baroda 5.4%. The weaknesses of Dena Bank are being diluted by pooling them with the strengths of the other two.

The government’s move to merge two better performing banks – Bank of Baroda and Vijaya Bank – with a weak one – Dena Bank – is a good strategy to ensure stability of both, operations and the credit profile of the consolidated entity. The success of the three-way merger will be crucial as it will pave the revival path for other weak state-owned banks through mergers. Moreover, the merger will reduce the capital burden for the government over the long term.

Vodafone-Idea Merger

Why Merge?

With the rising challenges faced by the new giant in the mobile telecommunication sector, Vodafone India and Idea decided to merge their business after the sector witnessed a huge tariff war and reduction in margins with entry of new telecom operator Reliance Jio. On 31 August 2018, Vodafone India merged with Idea Cellular, and was renamed as Vodafone Idea Limited. However, the merged entity continues using both the Idea and Vodafone brand.

Significant developments

1. Sale of Tower Business:

On November 13, 2017, Aditya Birla approved the sale of the Company’s standalone tower business held by its wholly-owned subsidiary, Idea Cellular Infrastructure Services Limited (ICISL) to American Tower Corporation (ATC) Telecom Infrastructure Private Limited Company with an enterprise value of ` 40 billion, subject to customary closing adjustments including for debt and cash. The sale of the standalone tower business was completed on May 31, 2018 by way of sale of the entire shareholding held by the Company in ICISL to ATC.

2. Name Change of the Company:

With the merger of Vodafone India Limited (VIL) and Vodafone Mobile Services Limited (VMSL) with Idea in final stages, the Board of Directors of your Company had approved the change of the name of the Company from Idea Cellular Limited to “Vodafone Idea Limited” on May 18, 2018.

3. Merger of Idea Mobile Commerce Services Limited with Aditya Birla Idea Payments Bank Limited:

The Scheme of Amalgamation of Idea Mobile Commerce Services Limited (IMCSL), a wholly owned subsidiary with Aditya Birla Idea Payments Bank Limited (ABIPBL), an associate was approved by the Honourable High Court of Delhi and Mumbai. The merger was subject to certain regulatory approvals and other conditions which got fulfilled on February 22, 2018. Accordingly, effective from February 22, 2018, IMCSL has been amalgamated with ABIPBL.

4. Proposed merger of Indus Towers Limited:

The Company, along with its wholly owned subsidiary Aditya Birla Telecom Limited (together referred to as Idea Group), Bharti Airtel Limited and Vodafone Group has entered into a transaction for amalgamation of Indus Towers Limited (Indus) into Bharti Infratel Limited (BIL)

Key takeaways:

Currently, the Vodafone Group holds a 45.1% stake in the combined entity, the Aditya Birla Group holds 26% and the remaining shares will be held by the public.

Kumar Mangalam Birla heads the merged company as the Chairman and Balesh Sharma used to be the CEO. After a plunge in share price of Vodafone Idea by 80% on NSE, Balesh Sharma resigned citing personal reasons. Ravinder Takkar, Ex-CEO of Vodafone Romania and the key deal negotiator from Vodafone has taken over the reigns as CEO.

The total number of telephone subscribers in India reached 1186.63 million as on 30 June 2019. The number of wireless subscribers are 1165.46 million and the number of wireline subscribers are 21.17 million. Vodafone-Idea ranks second with 320 million subscribers, just below the new leader Reliance Jio with 340 million subscribers in the Indian mobile telecommunications network

The transaction will cut Vodafone Group's net debt by nearly Rs 54,552 crore

The merged entity is jointly controlled by Vodafone India and the Aditya Birla Group

Balesh Sharma’s exit from Vodafone Idea Ltd (VIL) is an indication of the troubles being faced by the telecom company not just financially but also cultural clashes and turf wars between the employees of the two merged entities.

Comments